To prove the negative impact of the Spanish Matriculation Tax on the country’s luxury superyacht charter market, Nacional de Empresas Náuticas (ANEN), Asociación Española de Grandes Yates (AEGY), Asociación de Empresas Náuticas de Baleares (AENB) and the Mediterranean Yacht Broker Association have released the Spanish Matriculation Tax Study and Report (see below).

In addition, here is an exclusive interview with the President of The Balearic Islands from the Future of Superyachts Conference expressing very positive opinions about the Spanish government’s view on superyachts and the nautical sector in Spain:

SPANISH MATRICULATION TAX STUDY AND REPORT

The Report is an assessment of the economic impact of recreational boating in Spain with particular emphasis on the luxury Superyacht charter sector; it includes comparisons of the tax burden in Spain with that of neighbouring maritime countries such as France and Italy. It concludes by proposing a set of legal amendments which would modernise the outdated fiscal policy affecting recreational boating in Spain thus leading to improved competitiveness of the sector and the resultant generation of wealth and employment.

Information sources include statistics prepared by the Centro de Estudios Economicos Tomillo, data on boat registrations provided by MSI-Sistemas de Inteligencia de Mercado commissioned by ANEN, data sourced from reports by the Mallorca Chamber of Commerce on the economic impact of the large yachts sector and data from Superyacht Intelligence .

Economic impact of recreational boating in Spain

The first part of the report is a detailed analysis of the economic impact of recreational boating in Spain based on information taken from Spain’s National Statistics Institute’s input-output tables. This analyses the sector from a macroeconomic perspective, observing the trends and fiscal indicators. In addition it takes into account the all-important ´ripple effect´ which impacts upon productivity and employment in other sectors and is referred to as a multiplier factor.

A recreational craft requires services and products from many ancillary provider companies e.g. engines, outboards, generators, batteries, navigation equipment, electrics, electronics, refrigeration, paints, safety equipment, metal work, deck fittings, water tanks, woodwork, furnishings, chains, anchors, sails, masts, rigging, fuel, and countless other components.

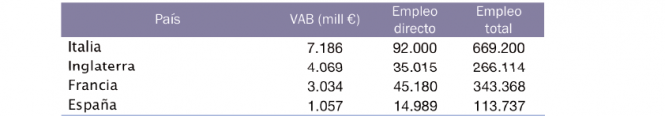

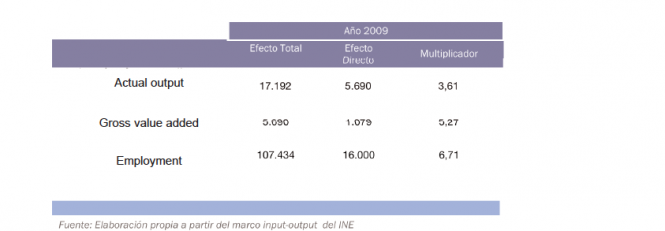

The statistics show that the value (in euros) of the Spanish recreational boating sector’s output has grown from 4.664 million in 2005 to 4,763 in 2009. The Gross Value Added (GVA) in 2005 was 1.057 million, rising to 1,079 in 2009. The number of direct jobs created rose from 15,000 in 2005 to 16,000 in 2009.

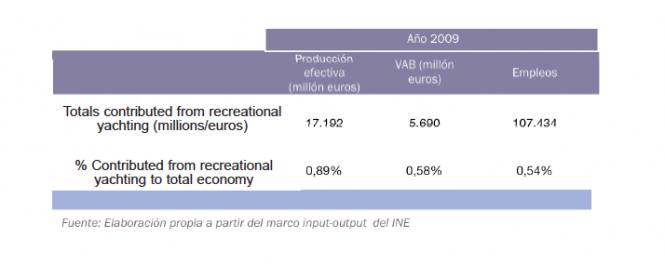

The economic multipliers for these figures show that that a multiplier of 6 greatly increases the employment figures (direct + indirect employment); the GVA has a multiplier of 5; and actual productive output has a multiplier of 3.61. The recreational boat sector is a sector with a high multiple effect due to the number and range of ancillary services and products supplied. See the graphs below for the multiplier effect and the overall impact on the Spanish economy.

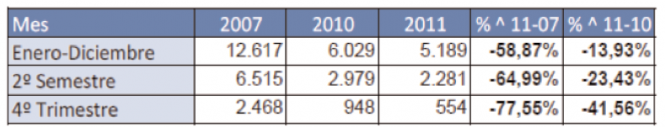

Analysis of recreational craft registrations

The report also details the number of registrations of recreational crafts over recent years. Comparisons of registrations of 2011 with 2007, (the year preceding the beginning of the recession), show a dramatic 58.87% decrease. The reduction of 77.55% in the 4th quarter is particularly striking. The conclusion is that the Spanish nautical industry is in clear recession, and to a much greater degree than other countries around us.

The report pays particular attention to large yachts including the average income generated by these vessels and their capacity to generate employment. Superyachts have been proven to have a remarkable direct effect on the economy due to the high costs involved in running and maintaining these vessels. Costs include crew, repairs, maintenance, navigation, fuel, provisioning, communications, docking, port charges, port taxes, private vehicles, cleaning and other expenses. Superyachts have to comply with certain minimum standards of repair and maintenance and so have no option but to spend in these areas.

Unfortunately, as a result of the uniquely prohibitive fiscal treatment that these yachts are subject to in our country only 14 of the 788 large commercial yachts based in the Mediterranean in the summer of 2011 were operating under a Spanish flag. (Source: Mediterranean Yacht Brokers Association).

This clearly indicates that Spain is missing the opportunity to generate wealth and employment. A report by Superyacht Intelligence recently found that Superyachts in the USA generate 28.860 direct jobs, in Italy 12.686 and in France 8.830. However in Spain, supposedly a world leader in the tourist industry, the large yacht industry only generates 5.682 direct jobs.

Taxation on Spanish yachting.

The Spanish tax levied on the acquisition and possession of recreational boats compared to that levied by countries around us has been thoroughly analysed in the report. The conclusion clearly shows that the marine industry in Spain is fiscally discriminated against in relation to our neighbouring countries and even in relation to other economic activities within our own country (such as the automotive industry).

In Spain we have a registration tax (Special Tax on Certain Means of Transport), which does not exist in any other country in the European Union. This imposes a 12% additional tax on the first definitive registration of recreational boats (new and used), which are more than 8 metres long and are intended for private use (except in the Canary Islands where it is 11%, and Ceuta and Melilla where it is not applied).

For recreational crafts, registered solely for charter activities, the tax applies to vessels that are more than 15 metres long. Moreover, unlike VAT, registration tax is not deductible. This tax is therefore adding 30% (combined VAT and registration tax) to the purchase price of a recreational boat which is over 8 metres long; this is much higher than the tax applied in Italy and France (between 19.6% and 20%). Indeed in other European countries like France or Italy fiscal benefits are offered in support of the nautical industry.

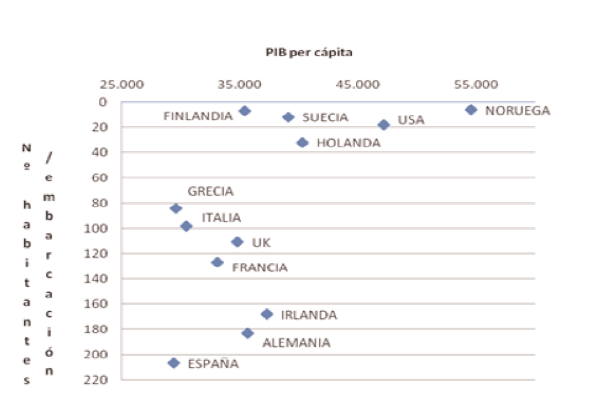

The statistics indicate the potential for growth of the marine industry in Spain. It is also clear that those countries with similar GDP per capita to the Spain (France, UK, Italy, Greece) have a much higher level of nautical development (residents with recreational craft).

Spain, one of the leading countries in the world of tourism, falls far short of its Mediterranean neighbours in terms of the relative weight of nautical tourism in the economic matrix.

The next graph shows the very small percentage that recreational yachting contributes to the overall Spanish economy. This graphically demonstrates the significant potential there is for growth from this sector, if only the economic barriers were removed and international competitiveness was restored.

The report’s in-depth analysis demonstrates conclusively that the nautical industry has a dynamic effect on the Spanish economy, and could produce much greater added value in terms of productivity and employment. In order to achieve this it is imperative that specific and justified fiscal and legislative changes are applied; these are detailed at the end of this document.

Economic impact of the nautical recreation in Spain and proposals for improvement.

Studies have predicted that if Spain were to adopt a fiscal policy aimed at stimulating nautical charter it could result in a 30% increase in turnover generated by super-yacht activities in the Mediterranean. In other words, the economic impact of this one sub-sector presently constrained by prohibitive taxes could easily triple the traditional charter revenue coming in to Spain.

According to estimates from the large yachts sector, the average expenditure per person, per day, is up to 450 euros.

Spain has excellent marinas (over 361 ports and over 130.555 moorings), but they are not covered by a national nautical tourism policy; indeed there is no clear, comprehensive global policy for the sector.

In conclusion, we are very confident that the adoption of the following measures would stimulate growth and employment in the recreational boat sector with a resultant positive impact on the Spanish economy as a whole. This increased activity would also generate higher tax revenues via all of the direct and indirect taxes (VAT, corporation tax, estate taxes, etc.). It is important to highlight that the jobs created would not be seasonal, unlike many of the traditional tourist related jobs. These jobs would be year round, as many of them are in sub-sectors and related activities such as yacht service and refit and repair. All of these areas are all highly developed in Spain.

Proposals

1. Modify the criteria for application of the tax (Special Tax on Certain Means of Transport) on those vessels that are obliged to register on the Ships’ Register: extend the current minimum length from 8 metres to 12 metres.

2. Modify the criteria for application of the Special Tax on Certain Means of Transport for EU flagged charter yachts to comply with recommendation by the European Union to the Spanish Government: either exempt or reduce (pro rata to charter period) the payment of the 12% tax on vessels engaged in the rental activity.

3. Develop a National Global Plan for Nautical Tourism.

Conclusion

* In addition to strengthening the strategic position of our country as a nautical tourist destination, these measures would allow us to recover many jobs that have been lost over the last few years. It is clear that the lower tax burden would immediately increase the number of companies engaged in all types of recreational boating activities.

* The Spanish government could raise much more in terms of direct and indirect tax revenue.

* This sector has a great potential for growth which impacts right across the Spanish economy and relates directly to tourism; still considered to be one of the most consolidated and powerful drivers of the Spanish economy.

One final fact: The tax revenue collected in Spain by way of excise duty (matriculation tax) on certain means of transport (recreational craft) amounts to a figure of 12,601.803 euros. (Actual matriculation tax revenue collected from yachting in 2011 – Source Spanish Central Tax Office.)

Personal acknowledgements to: Sr. Carlos san Lorenzo of ANEN, Mr Toby McClaurin of MYBA, Sra. Margarita Dahlberg of AENB and Sr. Bartomeu Bestard of FENIB