For the last 3 years, the Superyacht Singapore Association has been publishing its mid-year and full year Superyacht traffic reports. Superyacht traffic has been registering growth, but at times was not rising at the forecasted projection. Clearly such traffic is driven by many factors, notably, economic factors.

With the economy recovering slowly, 2010 would then be the year when Asia and more specifically Southeast Asia is back on track, to the great satisfaction of the regional Superyacht industry players and keen supporters; ranging from western builders, charter agencies, insurance brokers, to local Government bodies.

With the great success of the Second Edition of the Asia Superyacht Conference held in Singapore in October 2010 at ONE°15 Marina Club, the encouraging discussions towards the set up of a regional Superyacht association, the formation and very successful initiatives of the Indonesia Superyacht Association (ISA), working hand in hand with SSA, the first Asia-wide report on Superyacht traffic and ownership prepared by SSA and the agreement with the Informa Yacht Group to organize Asia’s first dedicated Superyacht show in April 2011 in Singapore, 2010 added a few building blocks to our long term objectives: offer Superyacht owners and families beautiful alternative destinations for their enjoyment and an excellent level of care for their precious yachts.

Here is the 2010 story…

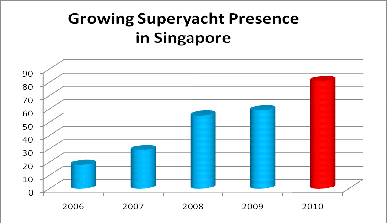

Growing Superyacht Presence in Singapore:

80 was the prized target the SSA was aiming at for total superyacht traffic for the whole year, up from 59 in 2009. By December 31st, we’ve reached the mark of 81, a target that appeared too ambitious to achieve when it was set in 2007.

It was not an easy task, but with determination and a team of dedicated members, SSA reached the mark above 80, in spite of experiencing the Global Financial Crisis and the ripple effect of piracy concerns in the Indian Ocean.

The Analysis:

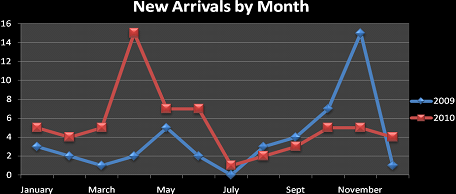

Peaks and troughs?

Year 2009 saw an increasing trend with higher yacht visitation in May and a significant jump in November.

Whilst in 2010, we saw a reverse in trend reaching its peak in the first half of the year, and a dip in November.

Nevertheless, findings based on these figures are not conclusive; in late 2009, the surge was linked to the arrival of distressed assets relocated in Singapore for sale, while the 2010 April’s peak can only be linked to migration period between the monsoon seasons. The last six months of the year were overall disappointing as the pace of growth of the first half of the year could not be maintained.

Milestone achieved – An encouraging moment:

In terms of Superyacht profile, the greatest highlight was the arrival of the super yacht Silver Zwei; the big and yet stylish 73-meter yacht arrived in Singapore for refuel and a few private functions before embarking to her next destination in Hong Kong.

Additionally, Sunseeker’s superyacht Tanvas, biggest -to-date, and motoryacht Mantra, a Pershing 80 and Pershing’s fastest yacht to-date were delivered in Singapore to their Singapore-based owners. Of course, it was purely coincidental that the beautiful shiny grey Pershing yacht was delivered right during the 2nd Asia Superyacht Conference and in the very exact marina where the conference was held.

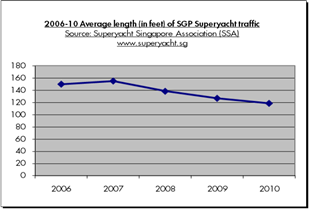

Average foot-run of superyachts:

Although the number of superyacht visits has grown by 37%, the overall average foot-run for visiting vessels has seen a drop from 127 feet in 2009 to 119 feet in 2010.

Instantaneously, we question if these figures are positively correlated. Herein lays an intriguing observation:

In 2008, we saw bigger yachts visiting, smaller in 2009, and smaller yachts still in 2010.

A few possible explanations can be brought forward:

1) The pace of yacht pick-ups and deliveries through yacht transportation companies kept increasing. Due to the latent piracy concerns in the Gulf of Aden, yacht transportation is a viable option to cruising on their own bottom. Added to that, Singapore is the obvious stop-over for all key shipping lines and ideal place for refueling and commissioning before cruising on their own bottom to their final destinations.

2) Second valuable reason is that cruising in Southeast Asia is more and more perceived by the yachting community as a fantastic cruising ground. As such, the number of good quality sailing yachts cruising through increased as well. For the 2nd Asia Superyacht Conference, SSA published a very interesting study that highlighted that if 85% of Superyachts owned in Asia are motoryachts, only 54% of all Superyachts cruising in Asia are motoryachts, the rest (46%) being sail yachts. If we compared to the motoryacht/sail yacht split in worldwide Superyacht population, clearly the appeal and ease of cruising in Asia with a large sail yacht makes a significant difference in cruising pattern.

3) In third, one can say that with better technology and communication, undertaking an ocean-crossing cruise on board a motoryacht below 140 feet may not be as daunting as it used to be. As such, more and more owner of yachts below 140 feet may now find discovering Asia more of a feasible option.

However, in terms of the overall total foot-run, the drop in overall average foot-run is largely compensated by the traffic increase. Overall foot-run (total foot-run of all visiting yachts added) almost reached 10,000 feet, which is a good benchmark for the future. This is of course Singapore’s highest to-date.

Segment analysis:

81 is an impressive milestone achieved on traffic visitations; but what can we say about the overall traffic performance in 2010? Segmented by regional, Singapore-based and non-regional based superyachts, an analysis is further dissected…

In 2009, Asia-owned and based yachts very much stopped moving across the region. However, 2010 proved to be quite different, probably testifying a more positive outlook on full economic recovery.

Regional Superyacht visits

A total of 10 Asia-based superyacht visits were recorded; an increase of 25% from 2009.

The first half of 2010 saw a gratifying 9 regional superyachts visiting Singapore, as opposed to only 1 in the same period from Jan – June 2009. Matahari superyacht measuring 160 feet in length was one of the 10; she arrived in Singapore in January. The rise in the number of regional superyachts visiting is evidence that not only is the regional economy recovering strongly but the superyacht industry in this region is growing by leaps and bounds.

Additionally, we saw relatively large yachts, sailing yacht Yanneke Too, Silolona superyacht, Brave Heart, YTL Princess, and motor yacht Lady Orient transiting Singapore.

Size-wise, the average yacht length dropped from 137 in 2009 to 118 feet in 2010. This probably highlights that superyacht cruising in Asia is not only limited to the super wealthy but are now also accessible to the “simply wealthy people”.

Singapore-based Superyachts

A total of 19 superyachts were recorded; 36% increase from 2009 or an increase of 4 superyachts, namely, super yacht Cygnus Montanus, Nymphaea, Tanvas, and yacht Mantra.

Cygnus Montanus superyacht (an 82-foot Swan) spent over one year in Singapore and finally moved for the Phuket season later part of the year.

Motoryacht Nymphaea, also one of the new arrivals, is a pre-owned 108-Broward purchased in the USA, and moved to Southeast Asia for an extensive interior refit to meet the need of the growing charter demand off Singapore. She is now marketed by ONE°15 Luxury Yachting and Simpson Marine, from Singapore where she is based.

Tanvas , Sunseeker’s largest yacht to-date, was delivered in Singapore and made her arrival in ONE°15 Marina Club where she has secured a long-term berth. After a few days, Tanvas motor yacht made her way to Phuket for the winter’s season.

Finally, Pershing’s motoryacht Mantra arrived in Singapore. A shiny superyacht awarded for Best of the Best Awards according to the 2010 Huron Report in China, ranking first for Best luxury yacht performance, cruising at a top speed of 41 knots.

Superyachts under construction in Singapore

This year, we included in a new category of superyachts under construction in Singapore with a 128 foot long yacht and another 90 foot long currently being built locally. As we receive wind of such exciting news, it is evident that increasingly more companies have embraced the vision and belief in Singapore’s potential to become a superyacht hub and destination one day. In the same line, within SSA members alone, quite a significant number of new builds, refits or conversions are either on the way or in final planning stage, either in local yards or in yards nearby.

Non-Regional Superyachts

Gathering information around superyachts’ movements has proved to be challenging for the non-regional based superyachts, mainly due to security or privacy reasons.

A total of 52 superyachts were recorded; 41% increase from 2009. By far, the best performed segment relative to the superyachts which arrived from regional waters, and Singapore-based superyachts.

Statistics captured were to our best knowledge and based on this, several interesting observations could infer as:

- Superyachts visit Singapore for a broad spectrum of reasons: recreation, refuel, and repairs and maintenances.

- Participating in the Boat Show Asia held in April, Singapore, entries of superyachts My Issue and Vega, has helped increase the statistics gathered for the traffic report to a peak of 15 superyachts visited in the month of April.

Length-wise, average length is the same for both 2009 and 2010.

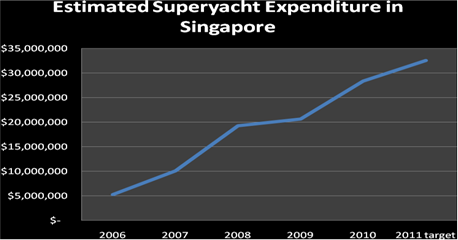

Revenues generated:

On average, a superyacht is estimated to spend an average of S$250,000 in Singapore on berthing fees, repairs, fuel, maintenance, supplies, etc). Based on these figures, we can infer an increasing trend in spending, and clearly this is a positive contribution to the Singapore economy.

2010 Conclusions:

It appears that 2010 was not only back on track, but growing at a rate better than we expected, and SSA is proud to exceed the target of 80.

Important observations:

- It reiterates from 2009 that Singapore superyacht marinas are far from full occupancy. In the best case scenario, superyachts visitation could have reached above 150 units.

- Lack of cruising ground has not deterred Singapore from emerging as a stopover destination for superyachts to visit and transit.

- An obvious market potential would be the development of a refit centre whereby expenditures generated from the maintenances not only boost the economy, but also adds to the traffic visitation numbers.

- Statistics has shown that holding Conferences and Yacht shows does contribute to the rise in superyacht traffic.

- The arrival of some superyachts in Singapore lends an insight to a new trend of technology innovation.

- A growing demand for charter in Singapore is available to those who are open to a new source of lifestyle entertainment.

The main reasons behind the overall increase in traffic include:

1) Strong recovery of the global and regional economy;

2) Business optimism translating into more and higher quality charters, cruises undertaken by superyacht owners that travel further;

3) Trust in the security measures undertaken by government bodies of the cruising routes in the South-east Asia region; and

4) An increase in public education of the vast richness and beauty of the cruising routes and destinations in this region.

Outlook for 2011

Year 2011 will start with another first for SSA in showcasing the first Asia superyacht show, the “Singapore Yacht Show” (SYS) in April 8th to 10th. Organized by the Informa Yacht Group (IYG) in partnership with ONE°15 Marina Club, SYS will focus solely on yachts 80 feet and above with display of yachts available for sale or charter. Held in the later hours of the day (4pm-10pm), over 3,000 VVIPs from the region are invited and will be meeting some of the best Superyacht brands and discovering their latest products.

A preview of a ballet program before the Singapore Yacht Show is another highlight; it aims to attract some of the HNWIs and/or UHNWIs to visit Singapore as they watch their superyachts serenade in front of the newly opened Resorts World Sentosa integrated resort, augmented by laser shows.

The preview runs concurrently with the 3rd Asia Superyacht Conference, from April 6th to 7th. IYG aims to attract new participants to the conference, presenting new topics, and extending to a wider speaker audience, so as to reach new heights on the quality of the Conference, held in its third year.

A line-up of activities from the Singapore Tourism Board not limiting to arts festival, Singapore Biennale, F1, and, ITB Asia Travel is another major draw in attracting more visitors.

At the same time, most of the marinas are finalizing their completion in increasing the capacity of their berths, and this itself is a strong endorsement that the yacht industry is growing, and SSA looks forward to stronger support from their members and experiencing peaks in the traffic visitation report, at a target of 130.

Comments from the industry:

Simon Turner, Director, Northrop and Johnson Asia:

“These figures are very encouraging. Despite a heavily lagging global financial economy, superyacht owners are still taking to the high seas and Asia is firmly on the map. It is good to see the mix of non regional visiting yachts and more yachts being owned within the Asia region. As facilities and information increases on what is available for superyachts in the region, the numbers should continue to grow. This will eventually lead to a critical mass where much higher level investment is made, in marinas and refit centres, in waterfront property and more – which will really then in turn drive the number of superyachts owned and operated in the region.”

Franck Hardy, General Manager, ONE°15 Marina Club:

“The yacht industry is definitely growing, evident by the positive superyacht occupancy rate which doubled in 2009, and enjoying 50% occupancy in 2010. Noticeably, the trend is shifting to the Asian and regional waters for the superyacht owners to cruise. This could be attributed to new cruising grounds around Asia and SEA and the efficient infrastructure Singapore can offer to the superyacht owners, a reason good enough for them to stopover in Singapore before embarking to other destinations.

Additionally, with depreciating dollars, it has become cheaper to own a yacht and people are thus becoming more willing to spend. The geography is definitely reaching out to the Asians, who are ranking ahead in their purchasing power capabilities, and growing sophistication in pursuing an elevated lifestyle.

With these encouraging numbers, the club will be completing its 3rd phase of expanding the marina to accommodate up till 270 berths. This serves as a catalyst to accommodating more superyachts, and even attracting more megayachts in Singapore.

In conjunction with the 3rd Asia Superyacht Conference and the first ever Singapore Yacht Show to be held at ONE°15 Marina Club in April, the increase in berths is definitely a strategic move to help SSA promote the yachting industry.”